The Rainy Season Dilemma: What Employees Really Want vs What HR Should Do

Why You Must Own Employer Branding for Talent Success

When it comes to running a successful business, it goes beyond making grand gestures or lavish awards, it is typically sustained by tiny, regular acts of unwavering dedication. One of the most unpopular of those acts? Payday.

For most employees, salary day is not just a routine event, it’s a deeply personal milestone. It reflects appreciation, security, and validation for the hours and energy they’ve invested into your company. So, when something goes wrong, whether it’s a missing allowance, an underpayment or a late transfer, it can send ripples of frustration, doubt, and resentment through your workforce. In fact, few administrative blunders can damage employee trust faster than payroll errors. This is why payroll reconciliation is not just a finance function, it’s a trust-preserving ritual.

What is Payroll Reconciliation?

Payroll reconciliation is the process of verifying that every part of your payroll, wages, bonuses, deductions, taxes, benefits, and contributions is correctly calculated, reported, and paid. It means comparing your internal payroll records against external documents such as bank statements, tax reports, and accounting books. It’s not just about checking if the salary was paid; it’s about ensuring every number involved in that transaction is accurate.

Think of it like balancing your personal account after a month of spending. You want to know that what your bank statement says matches what you’ve spent, saved, and transferred. For businesses, this level of precision matters tenfold, because payroll doesn’t just involve one person’s money, it involves the trust and financial well-being of an entire workforce.

How Payroll Reconciliation Is Done

Payroll reconciliation is done by gathering internal and external financial documents, comparing them for accuracy and completeness, investigating any discrepancies or errors found, and making necessary adjustments to ensure the payroll register aligns with the external records. This multi-step process confirms that all payments, deductions, and statutory remittances are correct, ultimately ensuring financial accuracy and compliance.

Here’s a breakdown of the process:

1. Data Gathering

Collect: all relevant internal payroll records, such as time cards, time sheets, and the payroll register.

Gather: external documents, including bank statements, general ledgers, and records of statutory remittances.

2. Comparison

Match: the internal payroll register against the external financial documents.

Check: that the gross pay, deductions, taxes, and net pay calculations on your payroll register align with the corresponding transactions recorded in your bank and general ledger.

3. Analysis and Investigation

Identify: any discrepancies or irregularities, such as missing transactions, incorrect amounts, or unrecorded changes.

Investigate: the root cause of these discrepancies, such as data entry errors, missing timesheets, or unapproved last-minute changes.

4. Adjustment and Correction

Rectify: any identified errors by making necessary corrections to the payroll records or financial accounts.

Ensure: that all adjustments are accurately made and properly documented to maintain a balanced and correct record.

5. Final Review

Review: the corrected records and adjusted amounts to confirm that all discrepancies have been resolved.

Confirm: that all internal records and external documents are in agreement, ensuring the payroll is accurate and compliant before finalizing it.

Why Payroll Reconciliation is Important

1. Trust: The importance of payroll reconciliation goes beyond just accuracy. First, it builds trust. When employees receive the exact amount they were promised, consistently and without delay, it strengthens their confidence in the organization. On the flip side, constant payroll errors can lead to dissatisfaction, complaints, or even legal issues.

2. Compliance: Payroll reconciliation helps ensure compliance. In many countries, Nigeria included, businesses must follow strict labor and tax laws. Mistakes in tax deductions or pension remittances can lead to hefty penalties, audits, or strained relationships with regulatory bodies. Reconciling payroll helps organizations stay on the right side of the law.

3. Prevention of fraud: Payroll reconciliation helps prevent fraud. By checking your records regularly, you can catch suspicious patterns, overpayments, ghost workers, or unauthorized deductions. Without reconciliation, such anomalies might go unnoticed for months, silently bleeding company resources.

4. Organized financial record: It keeps your financial records clean and audit-ready. A well-reconciled payroll ensures your financial statements reflect the true cost of employee compensation, which is vital for decision-making, budgeting, and reporting to stakeholders.

Conclusion

Payroll reconciliation may not be the most glamorous part of HR or finance, but it is undoubtedly one of the most critical. It’s the silent guardian that keeps your payroll accurate, your employees happy, and your business compliant.

Whether you run a small startup or a large enterprise, making payroll reconciliation a routine process is a smart investment in your company’s integrity, stability, and long-term success.

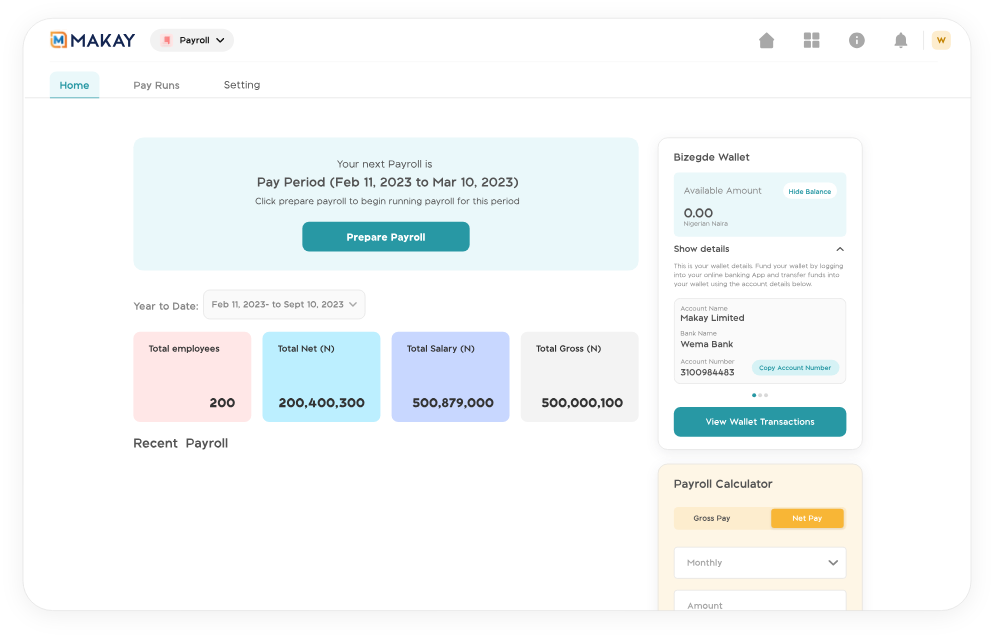

After all, when the numbers are right, everyone sleeps better at night. So, join thousands of businesses running payroll the simple and smart way by signing up with BizEdge or download The Ultimate Payroll Cheat Sheet that we created just for you.